Looking for a convenient and hassle-free way to get loans online? Look no further than Lendon! Whether you’re in need of extra cash for unexpected expenses or want to fund your dream vacation, Lendon offers a comprehensive platform that can help you secure the funds you need quickly and easily. In this blog post, we will provide you with a comprehensive guide on how Lendon works, its pros and cons, as well as step-by-step instructions on how to apply for a loan. So sit back, relax, and let’s dive into the world of online lending with Lendon!

What is Lendon?

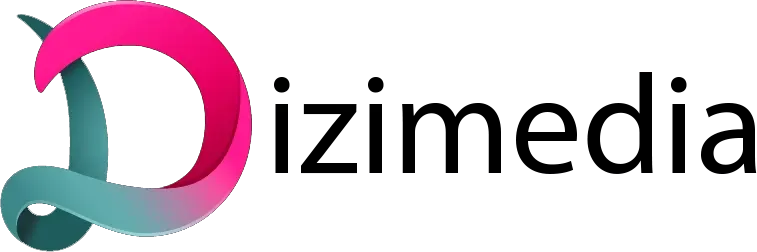

Lendon is an online lending platform that connects borrowers with lenders, making it easier than ever to obtain a loan. With Lendon, you can say goodbye to long and complicated application processes and hello to simplicity and convenience.

Unlike traditional banks, Lendon operates entirely online, which means you can apply for a loan from the comfort of your own home. No more wasting time waiting in line or filling out piles of paperwork!

One of the key features that sets Lendon apart is its quick approval process. By leveraging advanced technology and algorithms, Lendon is able to assess your eligibility for a loan within minutes. This means you won’t have to wait days or even weeks for a decision.

Another great thing about Lendon is their flexibility when it comes to loan amounts. Whether you need a small amount for emergency expenses or a larger sum for major purchases, they’ve got you covered. Plus, their repayment terms are designed to fit your individual financial situation.

The security of your personal information is always top priority at Lendon. They utilize state-of-the-art encryption technology to ensure that all your data remains safe and confidential throughout the entire borrowing process.

With its user-friendly interface and efficient system, Lendon makes getting loans online simple and straightforward. So why wait? Start exploring the possibilities with Lendon today!

How Lendon Works

Lendon is an online lending platform that provides a simple and convenient way for individuals to get loans quickly. The process is designed to be hassle-free and user-friendly, making it accessible to anyone in need of financial assistance.

To begin, you will need to visit the Lendon website and create an account. This involves providing some basic personal information and agreeing to their terms and conditions. Once your account is created, you can start the loan application process.

The next step is to fill out the online application form with details about your desired loan amount, purpose, and repayment term. Lendon offers flexible options tailored to meet individual needs. It’s important to provide accurate information so they can assess your eligibility properly.

After submitting your application, Lendon will review it promptly using their advanced algorithms and data analytics technology. They consider various factors such as credit history, income level, employment status, among others when evaluating applications.

If approved for a loan by Lendon’s automated system, you will receive a loan offer detailing the terms and conditions. You can then choose whether or not to accept the offer based on what works best for you.

Once accepted, funds are typically disbursed within one business day directly into your bank account. Repayment options are also flexible with multiple methods available including automatic debit payments from your bank account.

Lendon offers a streamlined borrowing experience by leveraging technology while ensuring transparency throughout the entire process. If you’re looking for a quick solution for short-term financial needs without jumping through hoops at traditional banks or lenders – give Lendon a try!

The Pros and Cons of Lendon

Lendon, like any other online lending platform, has its own set of advantages and disadvantages. Let’s take a closer look at the pros and cons of using Lendon for your loan needs.

One of the biggest advantages of Lendon is its convenience. Applying for a loan can be done entirely online, saving you time and hassle compared to traditional banking methods. With just a few clicks, you can complete the application process from the comfort of your own home.

Another benefit of using Lendon is its speed. The platform boasts quick turnaround times, meaning you can get approved and receive funds in as little as 24 hours. This is particularly useful if you’re facing an urgent financial situation that requires immediate attention.

Furthermore, Lendon offers flexibility when it comes to loan amounts. Whether you need a small loan or a larger sum, they have options available to suit various needs. This allows borrowers to access funds based on their specific requirements without being limited by rigid borrowing limits.

On the flip side, one potential drawback of using Lendon is that interest rates may be higher compared to traditional bank loans. While this might deter some borrowers seeking lower rates, it’s important to note that online lenders often cater to individuals with less-than-perfect credit histories who may not qualify for bank loans.

Additionally, since Lendon operates solely online, there may be limited customer service support available compared to brick-and-mortar banks. While they do offer assistance through their website and email channels, those who prefer face-to-face interactions might find this aspect lacking.

How to Apply for a Loan with Lendon

Applying for a loan with Lendon is a straightforward and hassle-free process. Whether you need funds for unexpected expenses or to pursue your dreams, Lendon provides an easy way to access the money you need.

To apply for a loan with Lendon, start by visiting their website. The user-friendly interface makes it simple to navigate through the application process. You will be asked to provide some basic personal information such as your name, contact details, and employment status.

Next, you will need to submit some financial information including your income and any existing debts or obligations. This helps Lendon assess your ability to repay the loan.

Once you have completed the application form and submitted all required documents, Lendon’s team of experts will review your application promptly. They understand that time is of the essence when it comes to financial needs.

If approved, you will receive a loan offer tailored specifically to your requirements. Take the time to carefully review all terms and conditions before accepting the offer.

Upon acceptance of the loan offer, the funds will be deposited directly into your bank account within a short period of time. It’s that simple!

So if you’re in need of quick cash without jumping through hoops at traditional banks, consider applying for a loan with Lendon today!

Get Your Loan Now

Now that you have learned all about Lendon and how it works, you are ready to take the next step and get your loan. Applying for a loan with Lendon is quick and easy, making it a convenient option for those in need of immediate funds.

To start the process, simply visit the Lendon website and fill out their online application form. Provide accurate information about yourself, such as your personal details, employment status, income information, and the amount you wish to borrow. The entire application can be completed within minutes from the comfort of your own home!

Once you have submitted your application, Lendon will review your information and assess whether they can offer you a loan. Thanks to their advanced technology-driven evaluation process, they strive to provide fast decisions so that you don’t have to wait long for an answer.

If approved for a loan by Lendon, they will send you an agreement outlining all the terms and conditions. It is crucial that you carefully read through this document before accepting it. Make sure you understand everything about interest rates, repayment schedules, fees (if any), and any other relevant details.

Upon accepting the agreement electronically or signing it physically if required by Lendon’s policies or regulations in your region), the funds will be deposited into your bank account swiftly. Depending on how quickly your bank processes transactions, you may receive the money within hours or at most within one business day.

Remember that borrowing money always comes with responsibilities. Ensure that taking out a loan is necessary for meeting immediate financial needs or achieving important goals rather than indulging in unnecessary expenses. Responsible borrowing allows individuals like yourself to manage finances effectively while building creditworthiness along the way.

So why not explore this convenient avenue offered by Lendon? With their user-friendly platform providing access to loans without lengthy paperwork or complex procedures – getting financial assistance has never been easier! Don’t let unexpected expenses derail your plans; instead, take control of your finances today with Lendon.