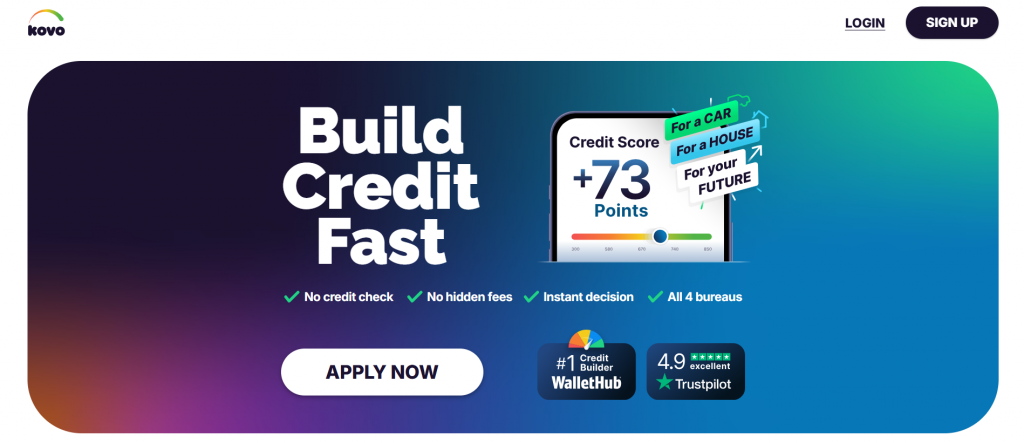

In a world where financial stability often feels like an elusive dream, managing our personal finances can sometimes seem more daunting than it should be. Enter Kovo: the innovative platform that’s shaking up the way we approach budgeting, saving, and investing. Imagine having a savvy financial advisor right at your fingertips—one that not only helps you track expenses but also empowers you to make informed decisions about your money. In this blog post, we’ll dive deep into how Kovo is revolutionizing personal finance management by blending cutting-edge technology with user-friendly design. Whether you’re a seasoned investor or just starting on your financial journey, get ready to unlock new possibilities for achieving your monetary goals!

Understanding the Concept of Personal Finance Management

Personal finance management involves tracking and managing your financial resources effectively. It encompasses budgeting, saving, investing, and planning for future expenses. At its core, it’s about making informed decisions with your money. Understanding income sources helps you allocate funds wisely. This ensures that essential needs are prioritized while also allowing for savings and investments. With the rise of technology, personal finance tools have made this process easier than ever. They allow individuals to visualize their spending habits and recognize areas for improvement. Financial literacy plays a crucial role here. The more you know about concepts like interest rates or compound growth, the better equipped you’ll be to make sound financial choices. Ultimately, mastering personal finance management leads to greater confidence in handling money matters. It empowers individuals to achieve their goals without unnecessary stress or debt burdens.

How Kovo is Revolutionizing Personal Finance Management

Kovo is changing the way we approach personal finance management. With its intuitive interface, users can easily navigate their financial landscape without feeling overwhelmed. The platform employs advanced algorithms to analyze spending habits. This insight empowers individuals to make informed decisions about budgeting and saving. What sets Kovo apart is its real-time tracking feature. Users receive instant notifications about transactions, helping them stay on top of their expenses. Additionally, Kovo’s integration with various banks ensures seamless syncing of accounts. This eliminates the hassle of manual entry and reduces errors significantly. The app also prioritizes user education, offering personalized tips tailored to individual financial goals. This fosters a sense of accountability while making finance management less daunting. All these elements combine to create a unique experience that resonates with both novices and seasoned finance enthusiasts alike.

Key Features and Benefits of Using Kovo

Kovo stands out with its intuitive interface. Users can easily navigate through their financial data without feeling overwhelmed. The app offers real-time tracking of expenses and income. This feature helps individuals maintain a clear view of their financial health at all times. One notable benefit is the personalized budgeting tool. Kovo analyzes spending habits and provides tailored suggestions to improve savings. Another key feature is goal setting. Users can define specific targets, whether it’s saving for a vacation or paying off debt, making financial planning engaging and actionable. Kovo also integrates bank accounts securely, ensuring that users have a complete overview of their finances in one place. With insightful analytics, users receive notifications about spending patterns, encouraging them to make smarter decisions daily.

Comparison with Other Personal Finance Management Tools

When it comes to personal finance management, many tools are vying for your attention. Kovo stands out in a crowded market. Unlike traditional budgeting apps that often focus solely on expense tracking, Kovo offers a holistic approach. It integrates savings goals with spending habits seamlessly. Many competitors require tedious manual entries. Kovo automates this process through smart algorithms that sync with your bank accounts. This saves users plenty of time and effort. Additionally, while some tools provide generic advice, Kovo tailors insights based on individual financial behaviors. This personalized feedback fosters better decision-making over time. User experience is another strong suit for Kovo. Its intuitive interface makes navigation smooth compared to clunkier alternatives that can frustrate newcomers or seasoned users alike. Ultimately, the blend of automation and personalization positions Kovo as a frontrunner among personal finance solutions available today.

Tips for Maximizing the Use of Kovo

To make the most of Kovo, start by setting clear financial goals. Understanding what you want to achieve can guide your use of the app. Utilize Kovo’s budgeting tools effectively. Break down your expenses into categories and track them regularly. This will help identify areas where you can cut back. Take advantage of Kovo’s notifications. Set alerts for bill payments and budget limits to avoid overspending or missed deadlines. Explore the insights feature. It provides valuable analytics on spending habits that can inform future decisions. Regularly connect with community resources within Kovo. Engaging with other users can offer fresh perspectives and tips that enhance your experience. Lastly, keep updating your financial information in the app. Accurate data ensures better tracking and improved recommendations tailored to your unique situation.

Future Developments and Updates

Kovo is continuously evolving to meet the changing needs of its users. The development team is actively gathering feedback to enhance user experience and functionality. Upcoming updates will focus on integrating advanced AI algorithms for personalized financial insights. This aims to make budgeting easier and more intuitive than ever before. Additionally, Kovo plans to introduce a community-sharing feature. Users will be able to connect, share tips, and learn from one another’s experiences. Security remains a top priority as well. Future versions will include enhanced encryption protocols to ensure that personal data stays protected. Lastly, expect new partnerships with banks and financial institutions. These collaborations could open up exciting opportunities for seamless transactions directly within the app.

Why You Should Try Kovo Today

If you’re looking to take control of your finances, Kovo is worth considering. Its user-friendly interface and innovative features make managing personal finance easier than ever. With tools designed for budgeting, tracking expenses, and setting financial goals, you can gain insights that lead to smarter decisions. Kovo stands out with its emphasis on automation and personalization. This means less time spent worrying about money management and more time focusing on what truly matters in life. Success stories from users highlight how Kovo has transformed their approach to finance—helping them save money, reduce debt, or even invest wisely. The continual updates promise future enhancements that will keep the platform fresh and aligned with user needs. Whether you’re just starting your financial journey or looking for ways to optimize it further, trying Kovo could be a game-changer. Take the step toward better financial health today; explore all that Kovo has to offer and see how it can fit into your life seamlessly. You might find yourself wondering how you managed without it before!