Are you on the hunt for a financial solution that fits seamlessly into your lifestyle? Whether you’re looking to fund a dream vacation, consolidate debt, or manage unexpected expenses, choosing the right credit option can feel overwhelming. Enter Fiesta Credito—a contender that’s making waves in the world of personal finance! But does it truly deliver on its promises? In our comprehensive review of Fiesta Credito, we’ll dive deep into its features, benefits, and potential drawbacks. Join us as we explore whether this financial tool is worth adding to your arsenal or if you should keep searching for that perfect match. Your journey toward smarter finances starts here!

Introduction to Fiesta Credito and its services

Navigating the world of personal finance can be overwhelming, especially when you’re faced with unexpected expenses or urgent financial needs. Enter Fiesta Credito—a financial service that claims to simplify borrowing and put you in control of your monetary decisions. But is it really the right fit for you? In this review, we’ll dive into what makes Fiesta Credito a popular choice among individuals seeking quick loans and flexible repayment options. From how it works to customer experiences, we’ll explore all facets to help you make an informed decision about your financial future. Let’s embark on this journey together!

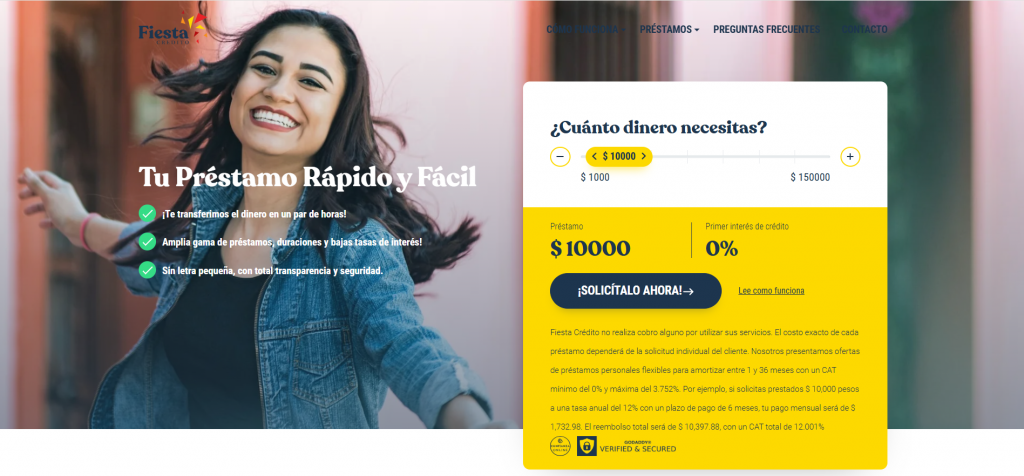

How does Fiesta Credito work?

Fiesta Credito operates with a straightforward online application process. Users simply visit their website, where they can fill out a form detailing personal and financial information. Once submitted, Fiesta Credito reviews the application quickly. Their technology assesses creditworthiness using various criteria beyond traditional credit scores. This makes it accessible to more individuals seeking loans. After approval, borrowers receive funds directly deposited into their bank accounts, often within 24 hours. The platform offers flexible repayment options tailored to individual budgets. Additionally, Fiesta Credito emphasizes transparency in its lending practices. Borrowers are informed of interest rates and terms upfront, helping them make informed decisions without hidden surprises.

Customer reviews and experiences

Customer feedback on Fiesta Credito varies widely. Many users appreciate the quick application process. They often mention how simple it is to navigate the platform. Some customers highlight positive experiences with customer service representatives. They report friendly and helpful interactions, making their borrowing experience smoother. On the downside, a number of reviews point out concerns about interest rates. Some borrowers feel that fees can be higher than anticipated, which adds stress to repayment plans. Others have expressed frustration over communication issues during their loan period. Delays in responses can leave clients feeling uncertain about their financial decisions. Despite these mixed feelings, many users value the flexibility that Fiesta Credito offers. It suits those who need immediate cash solutions without lengthy waiting times for approvals or disbursements.

Comparison with other similar financial services

When comparing Fiesta Credito to other financial services, it’s essential to look at key features. Many competitors offer traditional loan options with stringent requirements. Fiesta Credito, on the other hand, emphasizes accessibility for those with varied credit backgrounds. Another aspect is the speed of service. While some lenders take days or even weeks for approval, Fiesta Credito often processes applications quickly. This can be crucial when you need funds urgently. Interest rates and fees also play a significant role in decision-making. Some alternative lenders might charge higher interest rates or hidden fees that can catch borrowers off guard. Fiesta Credito aims for transparency in its fee structure, allowing users to understand their financial obligations clearly. Lastly, customer support varies widely across platforms. Users frequently report positive experiences with Fiesta Credito’s responsive customer service team compared to less attentive counterparts elsewhere.

How to apply for a loan with Fiesta Credito

Applying for a loan with Fiesta Credito is designed to be straightforward. Start by visiting their website, where you’ll find a user-friendly application form. Fill in your personal information. This typically includes details like your name, contact information, income, and employment status. Make sure all the data is accurate to avoid delays. Once submitted, you’ll receive a notification about the status of your application. Depending on the type of loan you’re seeking, this process can happen fairly quickly. If approved, review the terms carefully before accepting any offer. Understand interest rates and repayment schedules thoroughly. If you’re satisfied with everything presented, follow the prompts to finalize your agreement electronically or via paper forms as instructed by Fiesta Credito’s team.

Tips for managing your finances with Fiesta Credito

Managing your finances effectively with Fiesta Credito can be a game-changer. Start by setting clear financial goals. Knowing what you want to achieve makes it easier to map out your budget. Keep track of your expenses regularly. Use tools or apps that help categorize spending habits, ensuring you stay within your limits without overspending. Consider using automatic payments for loans. This helps avoid late fees and keeps your credit score healthy. Don’t hesitate to reach out for assistance if you’re unsure about any terms or processes related to Fiesta Credito’s services. Their customer support is there for guidance. Lastly, review your loan terms periodically. Understanding interest rates and repayment options allows you to make informed decisions that fit into changing circumstances in life.

Conclusion: Is Fiesta Credito the right choice for you?

Selecting the right financial service can be a daunting task. Fiesta Credito offers unique benefits that cater to those looking for accessible loan options. Their streamlined application process is designed with customer convenience in mind, making it easier for users to secure funds when needed. However, like any service, it has its pros and cons. Understanding these aspects helps you weigh whether this option aligns with your financial goals. Customer experiences provide valuable insights into how well the service performs and whether it meets expectations. Comparing Fiesta Credito with similar providers further informs your decision-making process. It’s essential to evaluate different services based on interest rates, repayment terms, and additional features they may offer. If you decide that Fiesta Credito could suit your needs, applying for a loan is straightforward. Just follow their guidelines carefully to ensure a smooth experience. Managing finances wisely while utilizing loans from any provider can make all the difference in achieving financial stability. With smart budgeting strategies and responsible borrowing habits, customers can maximize the benefits of their chosen service.