In a world brimming with personal finance apps, each promising to revolutionize the way we manage our money, it can be overwhelming to find one that truly delivers. Enter Kovo: the newcomer that’s making waves and turning heads in the sea of financial management tools. With its sleek design, user-friendly interface, and innovative features tailored for today’s savvy spenders, Kovo isn’t just another app—it could be your new financial best friend. But what exactly sets it apart from the myriad of options available? Join us as we dive deep into our comprehensive Kovo review and explore how this standout app empowers users to take control of their finances like never before!

Introduction to Kovo and its purpose

In today’s fast-paced world, managing personal finances can feel like a daunting task. With countless apps at our fingertips promising to simplify budgeting and tracking expenses, it can be overwhelming to find one that truly delivers on its promises. Enter Kovo, a fresh contender in the realm of personal finance tools designed to put you in control of your financial journey. Kovo isn’t just another app; it’s an all-in-one solution created with the user experience in mind. Whether you’re looking to budget better, track spending habits, or manage investments seamlessly, Kovo aims to support individuals at every step. But what sets this app apart from others out there? Let’s dive into what makes Kovo unique and discover if it could be the perfect match for your financial needs.

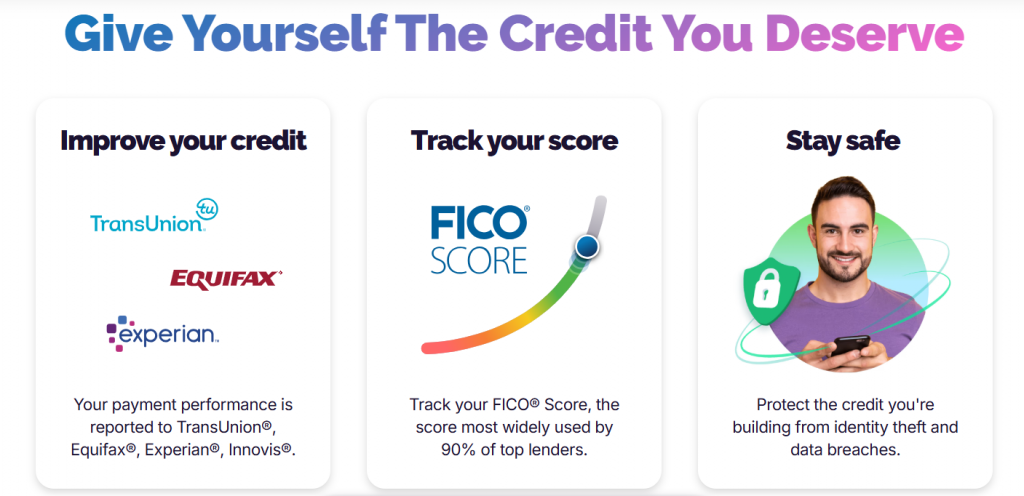

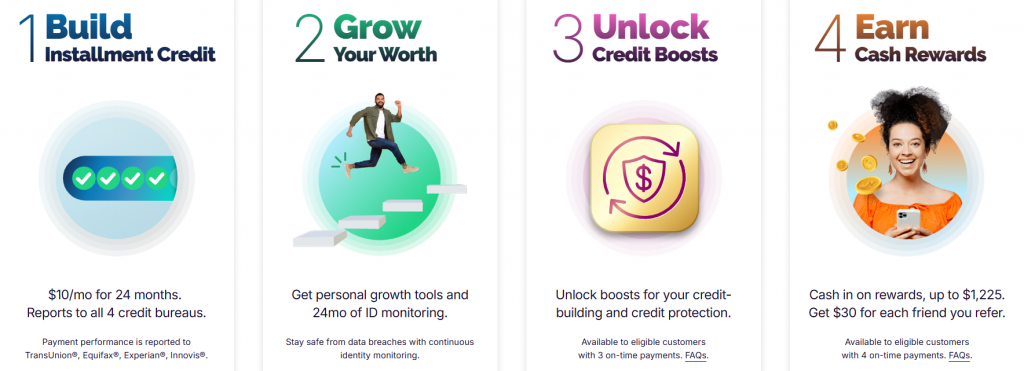

Features and benefits of Kovo

Kovo offers a suite of features designed to simplify personal finance management. Its budgeting tools empower users to set realistic financial goals and track their spending habits effortlessly. You can create budgets tailored to your lifestyle, ensuring that every dollar has a purpose. Expense tracking is another highlight. Kovo automatically categorizes transactions, making it easy to see where your money goes each month. This feature helps users identify spending patterns and make informed adjustments. Investment management sets Kovo apart from many apps in the market. Users can monitor their portfolios in real-time, receive insights on performance, and access educational resources for better decision-making. The user interface is clean and intuitive, enhancing the overall experience. Notifications keep you informed about bills due or budget limits reached, promoting proactive financial behavior without feeling overwhelming.

Budgeting tools

Kovo offers a robust set of budgeting tools that can simplify your financial planning. The app allows users to create customized budgets tailored to their specific needs and spending habits. With its intuitive interface, you can easily allocate funds for different categories like groceries, entertainment, or savings. Real-time updates help you track your progress against these allocations effortlessly. One standout feature is the ability to set financial goals within your budget. Whether you’re saving for a vacation or paying off debt, Kovo keeps you focused on reaching those milestones. Additionally, Kovo provides insightful analytics that highlight trends in your spending patterns. This information empowers users to make informed choices about where they might cut back or invest more wisely.

Comparison with other personal finance apps

Kovo enters a competitive field, where personal finance apps abound. Yet, it sets itself apart with its user-friendly interface and robust features. While many apps focus solely on budgeting or expense tracking, Kovo integrates both seamlessly. Users appreciate the way it combines these functions without overwhelming them. When compared to popular options like Mint or YNAB, Kovo offers unique investment management tools. This gives users a holistic view of their financial health in one place. Moreover, while some apps charge monthly fees for premium features, Kovo provides valuable functionalities at no cost. Many find this particularly appealing in today’s economy. The community aspect is another highlight; users can share insights and tips within the app. It fosters an environment that encourages learning and growth in personal finance management.

User reviews and experiences with Kovo

User reviews of Kovo paint a vivid picture of its effectiveness. Many users appreciate the intuitive interface, which simplifies complex financial tasks. Navigating through different features feels effortless. One user mentioned how Kovo transformed their budgeting habits. They found it easy to set goals and track progress, leading to better spending decisions. This level of engagement keeps users motivated. On the other hand, some feedback points out occasional glitches in syncing bank accounts. While these issues can be frustrating, they are not universal experiences. Additionally, customers value the investment management tools that come with Kovo. Users enjoy having everything consolidated into one app rather than juggling multiple platforms for finances. Many people also rave about customer support responsiveness when questions arise or troubleshooting is needed. Such high-quality service enhances user satisfaction significantly.

Tips for maximizing the use of Kovo

To get the most out of Kovo, start by setting clear financial goals. Whether you want to save for a vacation or pay off debt, having specific objectives helps tailor your budgeting. Take advantage of the app’s expense tracking feature. Regularly input your transactions and categorize them for better insights into spending habits. This can reveal areas where you might cut back. Utilize alerts and reminders effectively. Set notifications for bill due dates or when nearing budget limits to stay on track without stressing over finances. Engage with community forums if available within the app. Sharing experiences and tips with other users can provide new strategies and motivate you further. Lastly, review your progress frequently. Monthly check-ins allow you to adjust budgets based on changing circumstances or priorities, helping maintain momentum toward achieving those financial dreams.

Conclusion: Is Kovo worth it?

Kovo offers a refreshing approach to personal finance management. Its blend of budgeting tools, expense tracking, and investment management makes it stand out among the myriad of apps available today. Users appreciate its user-friendly interface and comprehensive features. The positive reviews highlight how Kovo simplifies money management for individuals at various financial stages. However, like any tool, it has its downsides. Some users may find certain features lacking compared to other specialized apps. For those looking to enhance their financial literacy and control over their finances, Kovo provides valuable resources that can empower informed decision-making. By leveraging all its tools effectively, users can maximize the benefits this app has to offer. Whether Kovo is worth your time depends on your specific needs and preferences in managing your personal finances. It certainly presents an appealing option for many seeking clarity in their financial lives.