Are you looking for a fast and hassle-free way to get your loan? Then look no further than Crezu. This online platform is a one-stop shop for your personal loan needs. It is designed with convenience in mind, allowing you to quickly apply, compare different offers, and make informed decisions. In this review, we take a closer look at what makes Crezu stand out from the competition, why it should be your first choice when looking for a personal loan, and how it can help you save time and money. So if you’re ready to get started on your loan journey, read on!

Are you looking for a personal loan that would be fast, easy, and hassle-free? If so, then you should check out Crezu. This online lending platform has been making waves in the financial world with its simple, straightforward process that gets you to cash in no time. In this blog post, we’ll take an in-depth look at Crezu and why it’s such a great option for those seeking a personal loan. We’ll give an overview of the company and its services, plus share reviews from actual customers who have had great experiences with the platform. Read on to see if Crezu is the right solution for your financial needs!

What is Crezu?

Crezu is a personal loan service that offers fast and easy loans to people in need. There are no credit checks required and you can get your loan in as little as 24 hours. All you need is a bank account and a job. You can use the money for anything you need, including bills, car repairs, or even vacations. Crezu is a great way to get the money you need when you need it.

Crezu is a personal loan service that offers fast and hassle-free loans to qualified applicants. With Crezu, you can get the money you need in as little as 24 hours, and there are no hidden fees or prepayment penalties. You can also choose to have your payments automatically withdrawn from your bank account, so you don’t have to worry about missing a payment.

Crezu is a personal loan company that offers fast and hassle-free loans to its customers. The company offers loans of up to $35,000 and has a simple online application process. Crezu also has a mobile app that allows customers to apply for loans and track their loan status on the go.

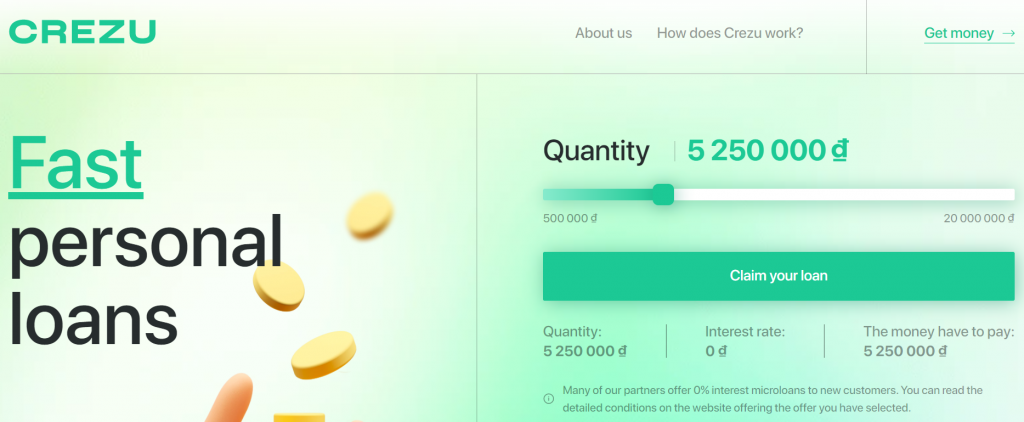

How Does Crezu Work?

If you’re looking for a personal loan but don’t want to go through the hassle of going to a bank or other lending institution, Crezu is the perfect solution. Crezu is an online platform that connects borrowers with lenders, making it quick and easy to get the money you need.

Here’s how it works: first, you fill out a short online form explaining how much money you need and what you’ll be using it for. Then, Crezu matches you with one or more lenders who are willing to provide the funds you’re looking for. Once you’ve been matched with a lender, you’ll be able to view their terms and conditions and decide whether or not you want to accept their offer. If everything looks good, simply agree to the loan and the money will be deposited into your account within 24 hours. It is that easy!

So if you need some extra cash and don’t want to go through the hassle of a traditional loan, be sure to check out Crezu.

The Pros and Cons of Using Crezu

The personal loan industry in the Philippines has been growing rapidly in recent years, with many companies offering quick and easy loans to consumers. Crezu is one of these companies, and in this article, we’ll be taking a look at the pros and cons of using their services.

On the plus side, Crezu offers fast approval for loans, with most applications being processed within 24 hours. They also have a very simple online application process, which makes it easy to get started. In addition, they offer flexible repayment terms, so you can choose a plan that fits your budget.

However, there are some downsides to using Crezu as well. One is that they have relatively high-interest rates, which can make repaying your loan more expensive than if you went with another lender. Additionally, they don’t currently offer any kind of grace period for late payments, so if you’re not able to make a payment on time, you’ll be charged a hefty fee. Overall, Crezu is a good option for those who need a personal loan quickly and don’t mind paying higher interest rates.

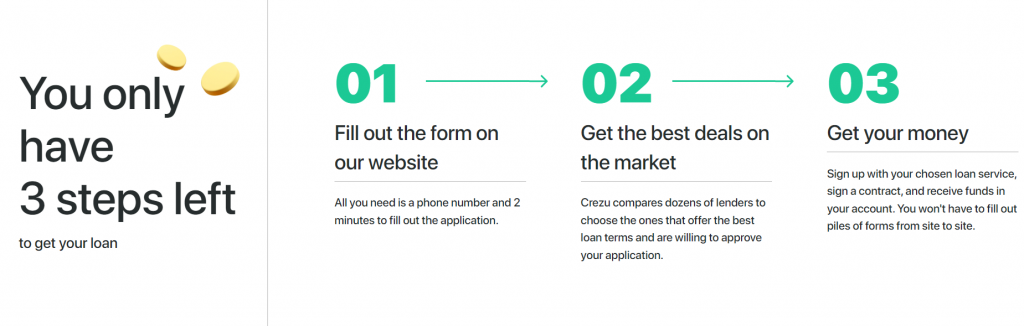

How to Apply for a Loan with Crezu

When you need extra cash, a personal loan is a great option. And when it comes to personal loans, Crezu is a fantastic choice. Here’s everything you need to know about how to apply for a loan with Crezu.

First and foremost, you’ll need to meet Crezu’s eligibility requirements. You must be at least 18 years old, a legal resident of the United States, and have a verifiable source of income. You’ll also need to have a valid email address and phone number.

Once you’ve confirmed that you meet all of the eligibility requirements, you can begin the application process by visiting the Crezu website and clicking on the “Apply Now” button.

Next, you’ll need to enter some basic information about yourself, including your name, address, date of birth, social security number, and annual income. Once you’ve entered all of the required information, click on the “Continue” button.

Now you’ll be asked to select the loan amount and repayment term that best suits your needs. Be sure to carefully consider these factors before making your selection. Once you’ve made your selection, click on the “Continue” button again.

At this point in the process, Crezu will conduct a soft credit check to pre-qualify you for a loan. This will not impact your credit score in any way.

If you’re looking for a personal loan, Crezu is a great option. Here’s how to apply for a loan with Crezu:

- Go to the Crezu website and click on the “Apply Now” button.

- Fill out the online application form with your personal and financial information.

- Once you’ve submitted your application, a representative from Crezu will contact you to discuss your loan options.

- If you’re approved for a loan, you’ll need to sign the loan agreement and provide any required documentation.

- Once your loan is funded, you’ll be able to use the money however you see fit!

Must Trust This For Loan

When you applied for a personal loan from Crezu, the company will ask for your bank statements and other financial documents to get an understanding of your financial history and current situation. Based on this information, Crezu will give you a loan offer with an interest rate and repayment terms that they think are fair and reasonable.

If you accept the loan offer, you’ll need to sign a loan agreement and provide Crezu with your bank account information so that they can send you the money. Once you have the money in your account, you can use it however you want – there are no restrictions on how you spend it.

Repaying your loan is easy – Crezu will automatically deduct the agreed-upon amount from your bank account on each scheduled repayment date. If you ever need to change your repayment date or amount, just contact Crezu and they’ll be happy to help.

Crezu is a great option if you need a personal loan quickly and without any hassle. The application process is straightforward, and you can get the money you need in just a few days. Plus, repaying your loan is easy – there’s no need to worry about missed payments or late fees.

Crezu is a great option if you need a personal loan quickly and without any hassle. The application process is simple and straightforward, and you can get the money you need in just a few days. Plus, repaying your loan is easy – there’s no need to worry about missed payments or late fees.