In a world where traditional banking is often seen as slow, cumbersome, and outdated, Zonky is stepping in to shake things up! Imagine a lending platform that not only connects borrowers with investors but also fosters a community built on trust and transparency. Welcome to the digital age of peer-to-peer lending—where your financial future isn’t dictated by faceless institutions, but shaped by real people like you. In this blog post, we’ll explore how Zonky is revolutionizing the way we lend and borrow money, breaking down barriers and paving the way for financial empowerment in an increasingly interconnected world. Get ready to discover why Zonky isn’t just another fintech app; it’s the game changer we’ve all been waiting for!

What is Zonky?

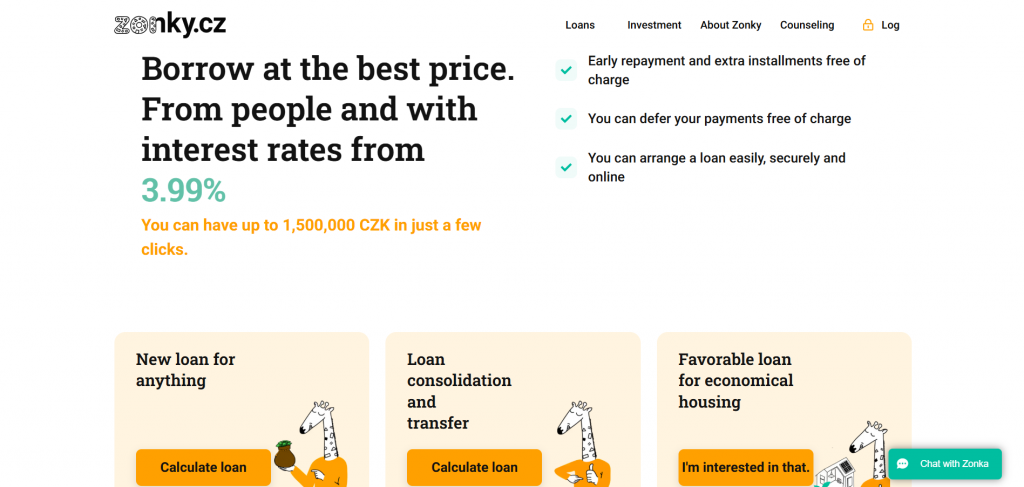

Zonky is a pioneering platform in the world of peer-to-peer lending. Launched to connect borrowers directly with investors, it cuts out traditional banks and financial intermediaries. At its core, Zonky aims to create a community where individuals can lend and borrow money transparently. Borrowers submit their loan requests while investors choose projects that resonate with them. What sets Zonky apart is its dedication to user experience. The interface is intuitive, making navigation seamless for both lenders and borrowers alike. Additionally, Zonky employs sophisticated algorithms to assess risks effectively. This data-driven approach provides more personalized loan options tailored to individual needs, ensuring better matches for everyone involved. In an era where digital solutions are key, Zonky stands out as a fresh alternative in the financial landscape. It fosters trust by emphasizing social responsibility alongside profitability.

How Zonky is Changing the Game in Peer-to-Peer Lending

Zonky is reshaping the landscape of peer-to-peer lending with its intuitive design. Users find it easy to navigate, making the borrowing and investing process seamless. This accessibility invites a broader audience, from seasoned investors to first-time borrowers. The loan structure offered by Zonky stands out due to its flexibility. Borrowers can secure funds for various needs while maintaining control over repayment plans tailored to their financial situations. That’s empowering for anyone seeking support without traditional bank constraints. Advanced technology plays a pivotal role in Zonky’s operations. By utilizing sophisticated data analysis techniques, they assess creditworthiness more accurately than ever before. This precision helps mitigate risks for lenders while providing fair rates for borrowers. Such innovations are not just enhancements; they’re game-changers that redefine trust and transparency in lending practices today.

User-Friendly Platform

Zonky stands out with its user-friendly platform designed for both borrowers and investors. Navigating the site feels intuitive, making it easy for anyone to engage in peer-to-peer lending without prior experience. The onboarding process is seamless. Users can quickly set up an account and access a wealth of information about available loans or investment opportunities. Visual elements enhance usability. Clean layouts, simple graphics, and straightforward navigation guide users effortlessly through their journey. Each step is clearly defined, reducing any potential confusion. Additionally, Zonky provides helpful resources like tutorials and FAQs. These tools empower users to make informed decisions while exploring their options within the platform. By prioritizing ease of use, Zonky opens doors to financial possibilities that were once reserved for traditional banking clients only. This accessibility fosters a more inclusive financial environment where everyone can participate confidently.

Innovative Loan Structure

Zonky’s innovative loan structure sets it apart in the competitive landscape of peer-to-peer lending. Unlike traditional banks, Zonky offers flexible borrowing conditions tailored to individual needs. Borrowers can choose from a variety of loan amounts and repayment terms. This adaptability empowers users to select options that best fit their financial situations. The platform also fosters transparency through clear interest rates and no hidden fees. Borrowers know exactly what they’re getting into, making the process more trustworthy. Investors benefit too. They can diversify their portfolios by funding multiple loans with varying risk profiles. This strategic approach enhances potential returns while minimizing exposure. By combining flexibility with transparency, Zonky transforms how people think about loans. It’s not just about borrowing money; it’s about creating opportunities for both borrowers and investors alike.

Advanced Technology and Data Analysis

Zonky leverages cutting-edge technology to enhance the peer-to-peer lending experience. By harnessing data analysis, it can offer tailored solutions for both investors and borrowers. The platform utilizes sophisticated algorithms to assess creditworthiness. This means faster approvals and more accurate risk assessments. Borrowers receive personalized loan options that fit their needs, while investors gain insights into potential returns. Real-time analytics help users monitor trends in the lending market. Zonky’s dashboard provides a clear view of performance metrics, making it easier for everyone involved to make informed decisions. Additionally, machine learning continuously improves these processes over time. As more data is gathered, the system evolves to identify patterns and opportunities previously overlooked. This innovative approach not only fosters trust but also enhances user engagement on the platform. Advanced technology shapes a dynamic environment where participants feel empowered throughout their lending journey.

Benefits of Using Zonky for Investors and Borrowers

Zonky offers a fresh approach to lending that benefits both investors and borrowers. For investors, the platform provides an opportunity to earn attractive returns on loans backed by real people. This connection fosters a sense of community while diversifying investment portfolios. Borrowers enjoy competitive interest rates that often undercut traditional banks. Zonky’s transparent process means no hidden fees or surprises, making it easier for borrowers to plan their finances. The peer-to-peer model also enables quicker loan approvals, allowing individuals access to funds when they need them most. Plus, with personalized loan options tailored to specific needs, borrowers can find solutions that fit their unique situations. This dynamic ecosystem empowers users on both sides of the transaction, creating a win-win scenario in modern finance.

The Future of Zonky and Peer-to-Peer Lending

Zonky is poised to redefine the landscape of peer-to-peer lending as it continues to innovate and adapt. The company’s commitment to user experience sets it apart. As technology evolves, so does Zonky’s platform. Expect enhancements that focus on simplicity and accessibility for both borrowers and investors. Additionally, with growing interest in sustainability, Zonky may explore green investment options. This could attract environmentally conscious users seeking ethical financial opportunities. Data analysis will play a significant role too. Improved algorithms can enhance risk assessment and personalize loan offerings, making transactions smarter than ever before. As more people embrace digital finance solutions, Zonky stands ready to lead the way in fostering trust within the lending community. Empowering users through transparency will only strengthen their position in an increasingly competitive market.

Is Zonky the Future of Lending?

As we navigate the evolving landscape of finance, Zonky stands out as a significant player in peer-to-peer lending. With its user-friendly platform and innovative loan structures, it brings accessibility to both borrowers and investors. The advanced technology employed for data analysis enhances decision-making, ensuring that users can engage with confidence. Zonky’s success stories reflect its impact on individuals seeking financial solutions and those looking to grow their investments. Statistics reveal a growing community that trusts this new model of lending, demonstrating reliability in an otherwise traditional market. Looking ahead, Zonky is poised to influence how people think about borrowing and investing. Its commitment to transparency fosters trust among users while pushing the boundaries of what peer-to-peer platforms can achieve. The question remains: Is Zonky truly the future of lending? It certainly seems that way as it continues to innovate and reshape our perceptions of personal finance in the digital age.