Introduction to Quicken

Welcome to the world of Quicken, where managing your finances becomes a breeze and financial empowerment is just a click away. In today’s fast-paced and ever-evolving world, keeping track of our money can sometimes feel like an overwhelming task. But fear not! Quicken is here to simplify your financial life and pave the way for a brighter future.

Quicken is not just any ordinary finance software – it’s an all-in-one solution that allows you to effortlessly take control of your money matters. From budgeting and bill tracking to investment management and tax planning, this powerful tool has got you covered. With its user-friendly interface and robust features, Quicken aims to streamline your financial journey while empowering you with the knowledge necessary to make informed decisions.

Features and Benefits of Quicken

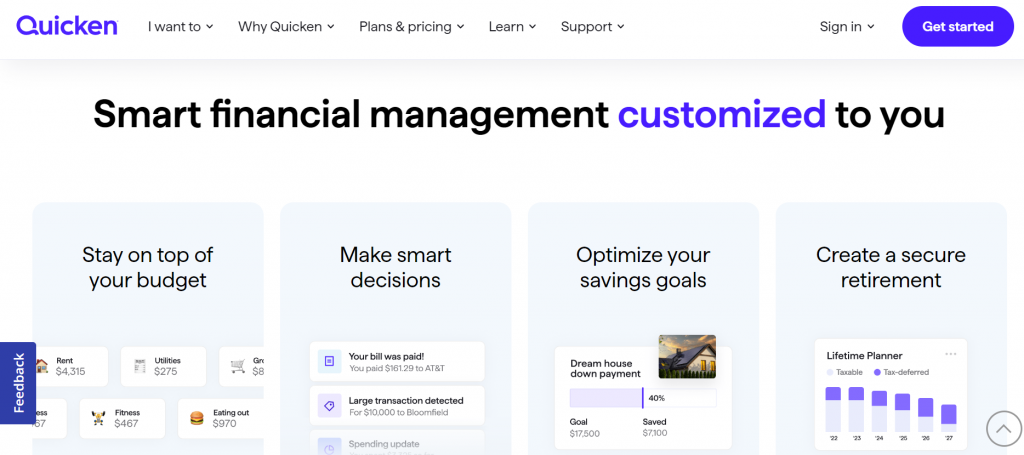

Quicken is a powerful financial management tool that offers a wide range of features and benefits for individuals and businesses alike. One of the key advantages of using Quicken is its ability to simplify the process of tracking your finances. With just a few clicks, you can easily monitor your income, expenses, investments, and budget all in one place.

Another great feature of Quicken is its robust reporting capabilities. You can generate detailed reports on your spending habits, cash flow, net worth, and more. This allows you to gain valuable insights into your financial situation and make informed decisions about saving money or cutting back on unnecessary expenses.

One unique benefit of using Quicken is its integration with popular financial institutions. By linking your bank accounts and credit cards to Quicken, you can automatically download transactions and keep them organized within the software. This saves time compared to manually entering each transaction individually.

Additionally, Quicken provides tools for managing debt repayment plans and setting up personalized savings goals. These features help users stay on track towards achieving their financial objectives.

Whether you’re an individual looking to better manage your personal finances or a small business owner wanting to streamline accounting processes, Quicken has something for everyone. Its user-friendly interface makes it easy to navigate even for those who may not be tech-savvy.

How to Set Up and Use Quicken

Setting up and using Quicken is a breeze, even for those who are new to personal finance management software. Here’s a step-by-step guide on how to get started:

1. Download and Install: Begin by visiting the official Quicken website and downloading the software onto your computer. Follow the installation prompts to complete the process.

2. Create Your Account: Once installed, open Quicken and create an account by providing your email address and setting up a password. This will be used to access your financial data securely.

3. Link Your Accounts: Next, you’ll need to link your bank accounts, credit cards, loans, and other financial institutions with Quicken. This allows the software to automatically import transactions and keep track of your finances in real-time.

4. Set Up Categories: Categorizing expenses is an essential part of budgeting effectively with Quicken. Take some time to set up categories that reflect your spending habits accurately – such as groceries, entertainment, utilities, etc.

5. Track Income & Expenses: As transactions start flowing into Quicken from linked accounts, review them regularly and assign appropriate categories so that you have a clear picture of where your money is going each month.

Tips for Maximizing the Use of Quicken

1. Customize your dashboard: One of the great features of Quicken is its customizable dashboard. Take advantage of this by adding widgets that display the information you want to see at a glance, such as account balances, upcoming bills, and investment performance.

2. Set up automatic categorization: Quicken can automatically categorize your transactions based on rules you set up. This saves you time and ensures accuracy in tracking your expenses. Spend some time setting up these rules initially to ensure all future transactions are properly categorized.

3. Utilize budgeting tools: Quicken offers robust budgeting tools that allow you to set spending limits for different categories and track your progress over time. By regularly reviewing and adjusting your budgets, you can better manage your finances and achieve your financial goals.

4. Stay on top of bill payments: Quicken’s bill payment feature allows you to schedule recurring payments and receive reminders when bills are due. Take advantage of this feature to avoid late fees and keep track of all upcoming payments.

5. Sync with mobile devices: Install the Quicken mobile app on your smartphone or tablet to access your financial information on-the-go. This way, you can easily check account balances, enter transactions, or make adjustments even when away from your computer.

Is Quicken Right for You?

After exploring the features and benefits of Quicken, as well as learning how to set it up and maximize its use, you may be wondering if Quicken is the right financial management tool for you. The answer ultimately depends on your individual needs and preferences.

If you are someone who wants a convenient way to track your finances, create budgets, monitor investments, and stay on top of bills all in one place, then Quicken can certainly simplify your financial life. Its user-friendly interface and comprehensive tools make it easy to manage your money effectively.

However, if you prefer more advanced financial planning features or require integration with specific banking institutions that may not be supported by Quicken, you might need to explore other options. It’s important to consider what aspects of personal finance management are most important to you before making a decision.

Whether or not Quicken is right for you will depend on factors such as the complexity of your financial situation and goals. If simplicity and convenience are high priorities for you when it comes to managing your finances, then giving Quicken a try could be worthwhile.