Looking for a hassle-free way to get a loan? Look no further than Crezu! In this comprehensive guide, we will walk you through everything you need to know about the popular online lending platform. Whether you’re in need of quick cash or looking for a long-term borrowing solution, Crezu has got you covered. So sit back, relax, and let us take you on a journey into the world of loans and borrowing with Crezu!

What is Crezu?

Crezu is an innovative online platform that connects borrowers with lenders in a seamless and convenient way. Whether you need funds for a personal expense, home improvement, or business investment, Crezu provides a simple and user-friendly interface to help you find the right loan option.

Unlike traditional banks or lending institutions, Crezu operates entirely online. This means no more lengthy paperwork or time-consuming visits to physical branches. With just a few clicks, you can access numerous loan offers from various lenders on the Crezu platform.

One of the key features that sets Crezu apart is its intuitive matching algorithm. By analyzing your financial profile and preferences, Crezu ensures that you are matched with loans that suit your specific needs and requirements. This saves you time and effort by presenting personalized loan options tailored to your unique circumstances.

In addition to its easy-to-use interface and smart matching system, Crezu also prioritizes security and privacy. Your personal information is encrypted and protected at all times, giving you peace of mind when applying for loans through their platform.

Whether you’re an individual seeking a personal loan or a small business owner in need of funding, Crezu offers a wide range of borrowing options to cater to different financial situations. From short-term payday loans to installment loans with flexible repayment terms, there’s something for everyone on this versatile platform.

With its user-friendly interface, personalized loan recommendations, top-notch security measures, and diverse range of borrowing options, Crezu has become the go-to choice for many individuals looking for quick access to funds without the hassle of traditional lending processes.

How does Crezu work?

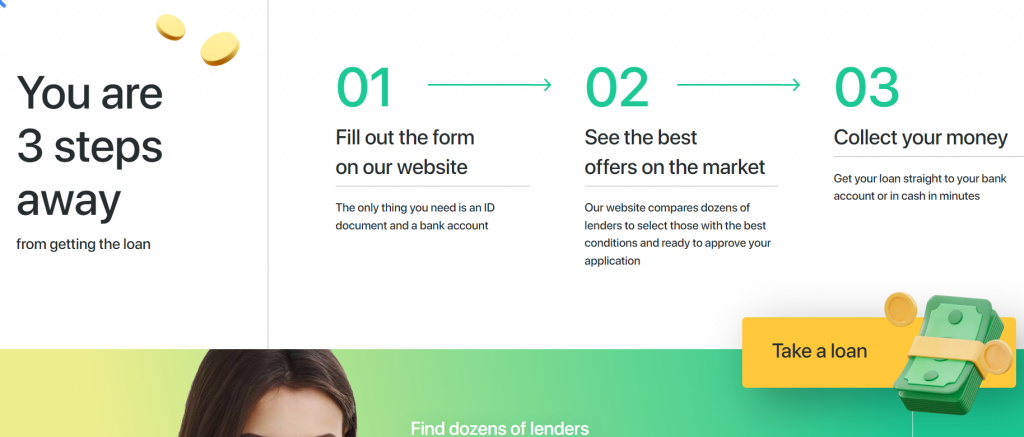

How does Crezu work? Crezu is a user-friendly online platform that connects borrowers with lenders, making the loan application process quick and hassle-free. With Crezu, you can apply for a loan from the comfort of your own home or office, eliminating the need to visit multiple banks or financial institutions.

To get started, simply visit the Crezu website and create an account. You will be asked to provide some basic personal information and financial details. This information is securely stored and used to match you with potential lenders who meet your borrowing needs.

Once your profile is complete, you can browse through available loan options and choose the one that best fits your requirements. The loans offered on Crezu range from personal loans to business loans, allowing individuals and businesses alike to access much-needed funds.

After selecting a loan option, you will be guided through the application process step by step. You may be required to submit additional documentation such as proof of income or identification documents. The entire process is designed to be simple and intuitive.

Once your application has been submitted, it will be reviewed by potential lenders who will assess your creditworthiness based on factors such as credit history and income stability. If approved, you will receive offers from various lenders detailing their interest rates and terms.

You have the freedom to compare these offers side by side before deciding which one suits you best. Once you accept an offer, funds are typically deposited into your bank account within a few business days.

Crezu works by providing borrowers with a convenient online platform where they can apply for loans tailored to their specific needs. By streamlining the lending process and connecting borrowers directly with lenders, Crezu makes borrowing money easier than ever before!

What types of loans does Crezu offer?

Crezu is a comprehensive online platform that offers a range of loan options to meet the diverse borrowing needs of individuals and businesses. Whether you are looking for a personal loan, business loan, or even a mortgage, Crezu has got you covered.

Personal Loans: If you need funds for unexpected expenses, debt consolidation, or any other personal reason, Crezu provides personal loans with flexible terms and competitive interest rates. You can easily apply online and receive quick approval based on your financial profile.

Business Loans: For entrepreneurs and small business owners in need of capital to expand their operations or invest in new ventures, Crezu offers various business loan options. From short-term working capital loans to long-term financing solutions, they cater to different business requirements.

Mortgages: Planning to buy your dream home? Crezu provides mortgage loans with favorable terms and conditions. They work with reputable lenders to bring you competitive interest rates and help make the process of purchasing property smoother.

Auto Loans: Looking to finance your next vehicle purchase? Crezu offers auto loans that allow you to borrow money at attractive rates specifically tailored for buying cars or motorcycles. With convenient repayment plans available, it’s easier than ever to get behind the wheel of your desired vehicle.

Student Loans: Education can be expensive but acquiring knowledge shouldn’t be hindered by financial constraints. That’s why Crezu also provides student loans designed specifically for covering tuition fees and other educational expenses. These loans come with flexibility in repayment options after graduation.

No matter what type of loan you require – whether it’s for personal reasons, starting a business venture or pursuing higher education – Crezu has an array of borrowing options available just for you! Explore their website today and find the perfect loan solution customized according to your specific needs.

How much can you borrow with a Crezu loan?

Crezu offers flexible loan options to meet your financial needs. The amount you can borrow with a Crezu loan depends on various factors, including your creditworthiness and income level.

Crezu provides both personal loans and business loans. For personal loans, the borrowing limit typically ranges from $1,000 to $50,000. This allows individuals to access funds for various purposes such as home improvements, debt consolidation, or unexpected expenses.

If you are a small business owner looking for financing options, Crezu also offers business loans ranging from $5,000 to $500,000. These funds can be used for expanding your business operations or investing in new equipment.

The specific loan amount available to you will depend on several factors including your credit score and history, income level, and the purpose of the loan. Additionally, lenders may have their own criteria that determine the maximum amount they are willing to lend.

It is important to note that while Crezu strives to provide competitive lending options and maximize borrowing limits for its users; approval amounts will vary based on individual circumstances.

In order to find out how much you may be eligible for with a Crezu loan application process is quick and easy! Simply fill out an online form providing some basic information about yourself and your financial situation. Once submitted; lenders within the Crezu network will review your application and present offers tailored specifically towards meeting your unique requirements.

What are the interest rates and fees associated with Crezu loans?

Interest rates and fees are important factors to consider when taking out a loan, and Crezu understands the importance of transparency in this regard. The platform offers competitive interest rates that vary depending on your creditworthiness, loan amount, and repayment term.

When you apply for a loan through Crezu, they will provide you with a personalized offer indicating the specific interest rate applicable to your situation. This helps ensure that borrowers have a clear understanding of their financial obligations before proceeding with the loan.

As for fees associated with Crezu loans, they strive to keep them as affordable as possible. While some lenders may charge origination fees or prepayment penalties, Crezu takes pride in offering loans without any hidden costs or surprises. However, it is always advisable to carefully review all terms and conditions before accepting any loan offer.

By providing transparent information about interest rates and fees upfront, Crezu aims to empower borrowers to make informed decisions about their borrowing needs. Remember that interest rates and fees can vary based on multiple factors such as your credit score and the duration of the loan; thus it’s crucial to explore different options available on the platform.

Is Crezu safe and secure?

In today’s digital world, the safety and security of our personal information is of utmost importance. When it comes to borrowing money online, we need to be confident that the platform we choose can protect our data and ensure a secure lending process.

So, is Crezu safe and secure? Absolutely! Crezu takes great pride in implementing robust security measures to safeguard your sensitive information. They utilize state-of-the-art encryption technology to protect your data from unauthorized access. This means that your personal details are encrypted during transmission and stored securely on their servers.

Furthermore, Crezu follows industry best practices when it comes to privacy policies and compliance with relevant regulations. They have strict protocols in place to ensure that only authorized personnel have access to your information and they undergo regular audits for continuous improvement.

Additionally, Crezu works with reputable lenders who adhere to responsible lending practices. This means that you can trust the loan providers connected through Crezu’s platform as they comply with all applicable laws and regulations governing loans.

It’s important to note that while Crezu prioritizes security, it is still essential for borrowers themselves to exercise caution when sharing personal or financial information online. Always double-check the legitimacy of any website or lender before proceeding with a loan application.

Based on its stringent security measures, commitment to privacy protection, and collaboration with trusted lenders, Crezu provides a safe environment for borrowers looking for loans online.

So why wait? If you’re in need of financial assistance or simply want more flexibility when it comes to borrowing money, give Crezu a try! Discover how this comprehensive platform can help connect you with suitable lenders who can meet your specific needs while ensuring the safety and security of your personal information throughout the entire process.